Early in January of 2012 I found myself struggling with the general terms around multi-channel, cross channel and omni-channel to adequately describe the rapidly evolving retail and e-commerce marketplace reality we all currently face.

Searching for a term that would better capture the full complexity and many drivers impacting the business, on January 3rd 2012 in a moment of epiphany I came up with the term and concept of Matrix Commerce on which topic this whitepaper is a primer.

Matrix Commerce describes the complex construct integrating marketing, sales, sourcing, pricing, profitability, service levels, delivery and consumer perceptions. Inherent in this is the notion of complete customer centricity from many of the above items extending to include customer desires for positive social outcomes relative to cause alignment and even the sustainability performance of companies they choose to do business with.

A mouthful for sure, but while you’re chewing on that start considering the types of real time and rapid processing systems which will be required to support such multi-facetted business decisions, not to mention the reams of big and not so big data that will be necessary for companies to collect in order to make them.

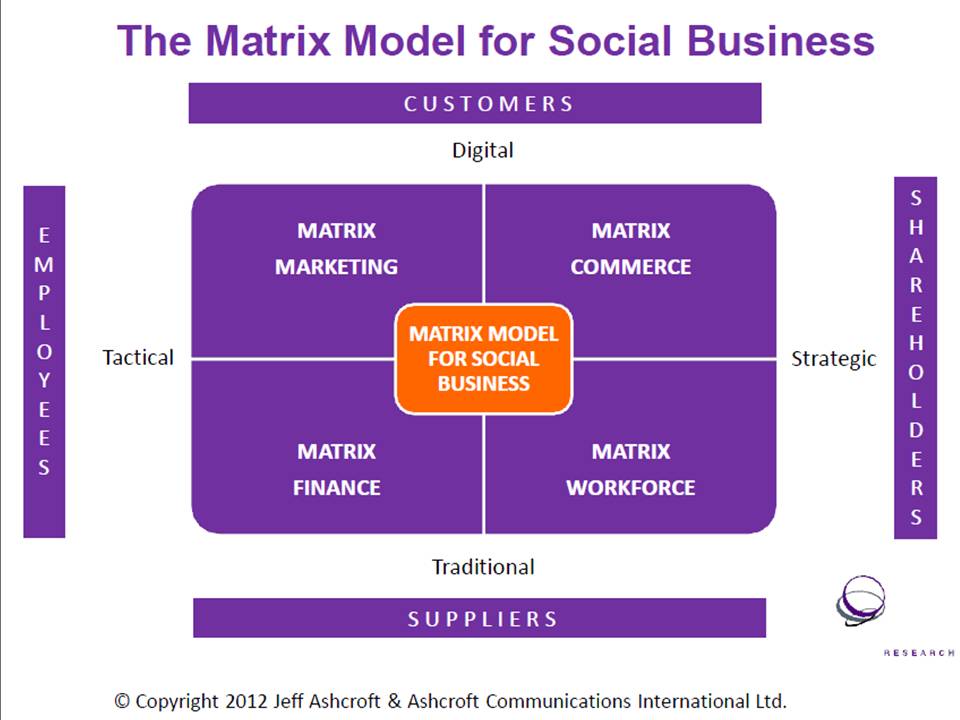

Representing the concept of Matrix Commerce diagrammatically is not an easy task and below is my first stab at it which I will continue to refine utilizing other more dynamic presentation graphics tools going forward.

In this first whitepaper on Matrix Commerce, I will start by addressing the aspects which directly impact the supply chain as those are near and dear to my heart as well as my current circumstances back working on the frontlines of the logistics business.

Store, locker, home or all of the above?

I’m not going to review here all the aggressive projections for e-commerce delivery growth but suffice it to say that depending on where you live in the world the numbers currently at 5 to 10% will be rapidly growing to 25 to 40%. This is a huge wakeup call for retailers with no e-commerce business or a poorly performing one, as it means they stand to lose a large chunk of their total sales to more adept e-commerce competitors.

What this means for the retail logistics executive is that in conventional terms he or she will need to make a bet every year on what the ratio between store and e-commerce delivery will be and adjust their DC & Fulfillment networks accordingly. This of course is a crapshoot and anything but an exact science, and for those seeking potential solutions I will share some of the suggestions I am working on.

Firstly, for purposes of full transparency I must state that I work for a third party logistics firm who does both retail store processing and e-commerce fulfillment and delivery. So for those who are still resisting the third party logistics wave or still simply sitting on the fence, this may be the final push to knock you off (3PL facilitated collaboration will be coming next if this doesn’t do it). As third party logistics firms work for multiple companies they are in a much more flexible position to utilize and allocate traditional store processing vs e-commerce fulfillment operations as these changes occur.

But for those of you still hardcore set on continuing to do it yourself, and I know you’re out there, some other automation options are starting to emerge that may also flexibly meet your needs. The first materials handling system solution I am tracking is the Fulfillment Factory from SSI Schaeffer. Big benefit here is that the same automation solution can support both store delivery picking and e-commerce order fulfillment picking from the same system. I still haven’t had the opportunity to visit the first such installation in the world in person, but hope to get in to see it in 2013. The above two solutions, 3PL or flexible automation potentially take care of this shift by giving operators the ability to deliver to store, lockers or direct to home as their consumer clients shift channels.

Demand Sensing and the Future of the Buying Decision

In the days of mass advertising and communication the business of demand creation was a much more straight forward affair. Brands created and presented themselves with little if any participation of the customer. Fast forward to today, where demand may still be created in more traditional ways, but in many cases it also becomes a matter of sensing where demand exists for the products you are selling.

And on top of this, immediate and even parallel consumer response can help to build and reinforce the brand story or when things go wrong, just as quickly damage or destroy it. When it comes to how many products to manufacture and where to make and deploy them of course the earliest and more accurate picture you have of demand the better decisions can be made.

Also, in the past it was brands and retailers who determined how and where you would buy their products and what price they would be sold for. Today, all those bets and the control that goes with them is gone. Also, demand is potentially even more volatile relative to the multiple ordering points and technologies available to consumers and the variety of delivery options they can choose from for those orders not to mention delivery same day or even in an hour for free! In fact companies such as Shutl are introducing services where they track and share their shortest delivery time on their homepage which is currently 14.58 minutes from order to delivery.

So in such a volatile supply chain environment how can we turn such ubiquitous communication and social technologies to our advantage? The answer is something called “Personal APIs”, those familiar with systems understand Application Programming Interfaces to be the rules published on a given system to effectively interface with them. So a ‘Personal API represents a methodology for a human being to define to businesses how he or she chooses to interface and do business with them. Once you get beyond the basics of what to call you, how to contact you and the like, there may be some interesting supply chain benefits surfaced. For example, should those with an API share information on their upcoming purchasing wants and needs, sales and supply chain folks would get the most accurate and early demand signal ever. This would also allow different suppliers of products meeting these needs to compete for the consumer’s business, meeting their specific configuration, timing and delivery needs.

One can only imagine the complexity of systems and base data required to manage 7 billion consumers online product needs once all consumers are connected to the internet which is only a matter of time, mobile ubiquity and the turnover of people. In fact the buying decision, personal sourcing and negotiation process itself may become so complex that consumers will begin to employ systems to buy most effectively on their behalf based on personally defined criteria. One example of such a criteria, that may cause those operating in the Matrix Commerce future issues, is sustainability as many consumers are aware of these issues and are ready to vote with their purchasing dollars.

The Linkage Between Technology and Sustainability

In the UK they are already marking retail products with their carbon footprint as well as identifying carbon neutral products and consumers are ready and willing to pay more for these. My personal opinion is that consumers all over the world will force businesses to adopt green practices going forward and cap & trade or something of a similar nature is now a matter of when not if. The next question becomes are you ready to make your supply chain as green as possible or even carbon neutral?

Once one accepts the need, the question then becomes how do you track the ‘actual’ and not assumed carbon footprint of a specific individual product from manufacture to consumption? Well the simplest part of this is the carbon footprint generated from production which is a factor of the energy source of the plant for the most part. So one number if coal, another if hydro and yet another if nuclear powered grid.

The complexity really starts when you look at the distribution of the products and how you can actually calculate and track the carbon footprint of a product sent to a store around the corner from the plant versus sending the same product to a store in Alaska.

The answer to this is to serialize every individual product and track/ attach actual carbon footprint and this is where technology comes in as the only way to effectively accomplish this is to use Radio Frequency Identification (RFID). In so doing the carbon footprint for the local delivery and the Alaska delivery are both accurately captured as just a byproduct of the ongoing product movement. And like anything, once you have the capability to easily measure something, you are now in a position to work effectively to reduce it.

The great news is although there have been fits and starts relative to widespread implementation of RFID, ongoing progress continues to be made and the more uses, needs and benefits it can perform the better the business case. Not only will such a deployment of RFID track carbon it will also capture precise service levels, delivery timing and reduce the costs of supply chain handoffs by eliminating paperwork and the need to check shipments manually 6 to 8 times in typical cases. Last but not least RFID in association with the needed Electronic Catalogues and SCM Standards will form the foundation for multi-company supply chain collaboration where co-distribution presents an opportunity for savings of 10 to 15% in typical supply chains. And once again these efficiencies will even further reduce carbon emissions fueling positive consumer perceptions of your firm to meet the growing expectation described above.

Undoing Thirty Years of DC Network Consolidation

Additionally as the consumer perceptions layer within Matrix Commerce for sustainability, free delivery and ever more rapid delivery continue to grow there will likely arise a need to undo many years spent consolidating DC networks.

As you practitioners know, resetting a national DC network can be a daunting and lengthy task with significant associated risk and cost. So should there be market drivers heading in that direction the sooner the need for this change is realized the better.

Historically most logistics networks grew up on a regional basis with regional DCs set up to service each of a company’s major market areas. In the late 1980’s with the advent of computer logistics network modeling, it became apparent that significant savings were available in both warehouse/DC costs and especially in inventory carrying costs by rationalizing and centralizing these networks. In fact this was my job for a number of years at the Hudson’s Bay Company where we cut our number of DCs from what was once more than 13 to on 3 generating savings of more than $25 million a year in operating expense.

However, the one component which increases quite significantly in these scenarios is transportation and in a non-carbon footprint / cap & trade world is not an issue, but as soon as this variable becomes significant where a significant rate is charged for every ton of carbon utilized, every centralized network out there suddenly becomes the inefficient, more costly solution.

In world of Matrix Commerce where do we go from here?

Concluding, going forward we will continue to delve into each of these Matrix Commerce issues in greater detail, but I hope this primer gives you food for thought and helps to crystallize the significant impact these growing consumer centric trends will have. So as a supply chain professional moving boldly into 2013, it might be prudent to ask yourself the question, ‘In a future world defined by Matrix Commerce, will my logistics network be ready?’ Companies who have no answer to this question may no longer exist in 5 year’s time as more customer centric and aligned market players eat their lunch!

Jeff Ashcroft