After releasing, What’s the Future of Business: Changing the Way Businesses Create Experiences, I also published a secret “bonus” chapter for those who finished the book and found the Easter egg at the end. Now, I’m making the bonus chapter available for everyone.

Why?

Because the four moments of truth explored in WTF not only define the modern customer journey, the link between the Zero Moment of Truth (ZMOT) and what I call the Ultimate Moment of Truth (UMOT) is more influential today than when the book originally published?

ZMOT represents the beginning of the discovery process, i.e. search or a request for help or guidance.

UMOT is the moment when someone encounters shared experiences of other customers, i.e. reviews, videos, word of mouth.

For the most part, we leave that encounter to chance. We instead invest in branded assets to connect the dots back to owned media. Yet, we all value the experiences our peers share and they’re incredibly influential in shaping the ultimate decisions we make. Defining those shared experiences is an incredible opportunity for true human-centered customer experience (CX).

In this WTF bonus chapter, the conversation extends from connecting the dots to measuring the impact of shared experiences, both negative and positive.

So, what is the true value of a customer’s experience and the value of it once it’s shared?

In this special section, I introduce a new methodology for measuring the value of shared experiences, “Social Referral Value” or SRV.

I hope this helps you!

“A genuine leader is not a searcher for consensus, but a molder of consensus.” – Martin Luther King, Jr.

What is the true value of a customer? I guess it depends on whether you employ any one of the existing customer value analysis formulas to measure customer worth such as Customer Lifetime Value (CLV); Recency, Frequency, Monetary (RFM); Share of Wallet (SOW); Past Customer Value (PCV); and every variation in between. One of the key challenges of course is to link these numbers to actionable insights applied specifically to those they’re intended to benefit.

Whether you believe CLV, RFM, SOW, PCV1 or any of the other derivatives of quotients provides the best measure of the value of your customers; you may in fact be missing the true value of your customers.

Most businesses seek to quantify ROI as a way of substantiating an investment. Additionally, decision makers seek to project earnings and validate overall strategies.

For some, measuring ROI also provides insight into what is important to customers so businesses can more effectively compete for the future. In both cases, customer-centric mathematics are supposed to help businesses determine the effectiveness of past strategies as they consider future allocation of resources and investments in service, marketing, and product development programs.

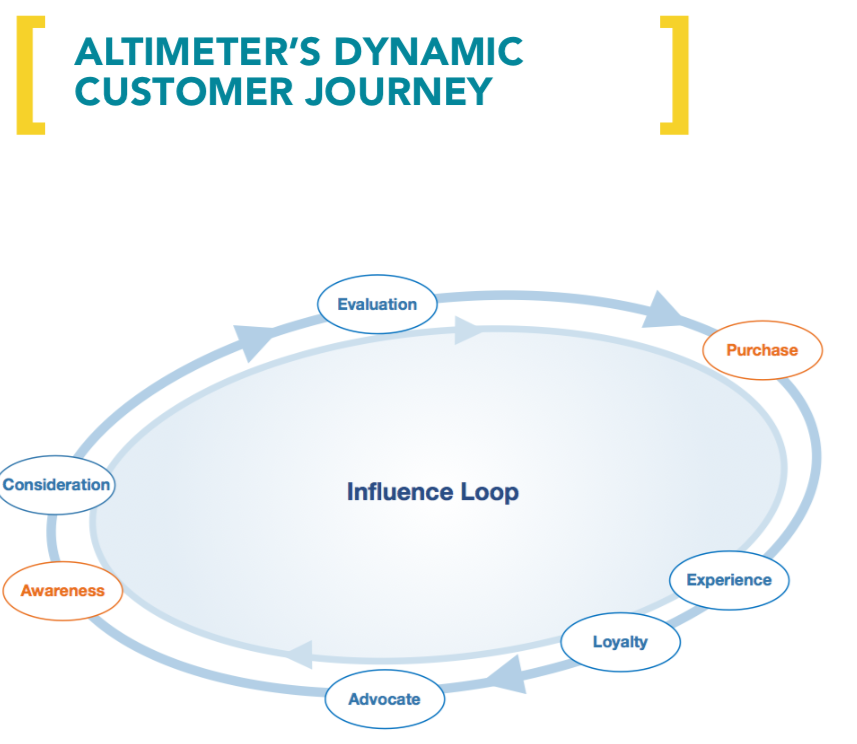

In a social economy, customer value takes on a new dimension. Customers are sharing their intentions, experiences and outcomes in online communities, social networks and mobile apps for others to discover at every step of the dynamic customer journey. Because of the discoverability of these shared experiences, what turns up from other customers affects the journey of the next consumer. In this dynamic ecosystem, decisions are made for and against you in real-time. Understanding the state of these shared experiences introduces previously unforeseen windows of opportunity for customer engagement and ultimately opportunities within emerging platforms.

Experience is everything

How customers feel when interacting with or around your business, at every stage of the journey, will dictate what they share about you online. Businesses need to monitor and assess these experiences, and ensure to craft experiences their customers enjoy. One of the key challenges facing businesses in a social economy, however, is that the behaviors of connected customers are no longer congruent with that of the traditional customers they were originally built to serve. In many organizations, customer service is still operated out of a call center; marketing is spread across multiple, yet siloed functions that follow the linear path within a traditional sales funnel; and product development follows a roadmap that looks so far ahead that it inevitably splits from evolving customer realities and expectations.

In the long run, this model in fact works against traditional businesses.

Why?

New technologies and the channels that arise as a result are causing important shifts in behavior and decision-making. And, this requires a deeper appreciation and grasp to better evaluate, measure, and sculpt desired relationships, experiences, and results.

The value of the experiences that customers share within communities, networks, and apps

is largely unrecognized or appreciated by businesses today. I’m not just referring to review sites such as epinions and the like from the Web 1.0 days. We must now include the scores of budding social, shopping and comparison networks and apps that are consuming the attention and time of connected customers.

We cannot measure what it is we do not know to value. Therefore, we cannot bring about change nor improve experiences if we do not know what shared experiences are or aren’t in these new outlets today.

Yes, businesses track customer activity and sentiment among a more traditional and studied set of behaviors, but all customers aren’t created equal. There are traditional customers. There are also connected customers. Not every customer is connected and not every customer is reliant on new networks and online peers to help them make or validate decisions. And, not all customers influence the activities of others online.

Measuring the return on investment of traditional customers is no longer good enough. Merely asking what’s the ROI doesn’t take into account the net return of shared experiences, or worse, the loss, on those shared experiences. Fixating on ROI also doesn’t answer the question of how new technologies are impacting decisions for or against you. It’s not designed to.

Without ignoring the importance of striving to find the ROI in all we do, asking another question will also help us see what it is we do not see today…shared experiences and why they matter to your company. So, the question is, what’s the return on experience and, how do you measure it?

There’s immense value in asking this question if you can discover the answers to the questions you do not already know to ask. This is a time when asking new questions will help us find new metrics and behaviors.

Even in the face of new technologies and subsequent consumer behavioral shifts, change cannot come about for the mere sake of change. Evidence must exist in proving that what could be is in fact as or more valuable than what is today. This is where mapping against the Dynamic Customer Journey comes in. It’s a form of digital ethnography that uncovers relevant interactions and transactions in rising online, social, and mobile networks and the new points and people of influence.

Customers represent a monetary value, whether negative, neutral or positive, and for the most part, the diverse array of metrics and formulas available to businesses today provide value and insight. Current customer metrics track everything from sentiment and satisfaction to revenue to perceived referral and loyalty value to lifetime value, but none of these metrics quantify how shared experiences within these networks add or subtract from the bottom line.

But customers and their shared experiences also represent a philosophical crux for businesses and the way executives view and value customers today.

While businesses are learning how to track the behavior and the value of their traditional customers, I’d argue that similar metrics and the philosophies governing them are dated. To compete for the future takes more than technology. It takes an understanding of how shared experiences affect consumer decisions within the customer journey. And it is in how these journeys unfold that reveal differences, not subtle nuances, but extreme dissimilarities in the decision-making process that requires a shift in perspective and approach.

Customer journey mapping is just the beginning. It’s the mindset that sees things through

a new lens and puts forth the changes necessary to engage customers in meaningful ways. This will only increase revenue and overall referral and lifetime value if businesses can better understand what customers actually value and how what they experience and in turn share impacts the decisions of others.

We need to evaluate these shared experiences and the extent of which we are in fact delivering against what it is we have stated in our brand promise. Doing so offers tangible insight rather than anecdotal assumptions on the relationship between customer satisfaction, peer-to-peer influence, and business performance.

So the question is, are you delivering a desired experience and if so, how are you measuring the way experiences and more importantly, shared experiences, are impacting your business?

But perhaps the real questions to ask are, have you articulated your brand promise and have you defined the experience you want customers to embrace, feel and endure. And, how does this experience trigger shared experiences to serve as a benchmark for which to measure against? Not only can you measure the value of shared experiences but you should also measure the integrity of the experiences you hoped to deliver.

Return on Experience (ROE)

In a time when the question of “What’s the ROI?” is as common in business as “How are you?” in interpersonal communications, we must now move from an era of soft business metrics to a more meaningful state to identify what’s really taking place, where, and what effect it’s having on the customer decision making process.

This move from intangible to tangible metrics and value is paramount as businesses have operated too long without it. Think about what decisions that are being made right now about the direction of your business without considering how the world is actually changing.

If businesses continue to pursue new technologies rather than focus on consumer behaviors, future strategies and investments will continually miss new targets and opportunities. Shared experiences in connected communities serve as the undercurrent for new consumerism. Customer journey mapping within new channels only reveals the context and influence of engagement that’s taking place today everywhere you’re not looking.

So what’s the return on shared experiences your connected customers are promoting, discovering, and valuing today?

Any standard search will reveal a host of formulas for calculating ROE. Rather than dive into the numbers, let’s build the case for its measurement and more so, a formal investment in experience!

How do you know today if your customer’s experience is as intended or hoped?

- Satisfaction surveys?

- Referring sources?

- Complex computations to capture CLV, RFM, SOW, PCV?

- Blind faith?

New philosophies and supporting models will help organizations compete not only against other companies but compete for the emerging class of connected and discerning customers. But, to truly measure the state of a brand or customer experiences and resulting relationships in this social economy is not only complicated, it’s also undervalued as a legitimate barometer.

These metrics are not easily compiled nor are their indicators and insights easily translated

into actionable and accountable areas of focus or responsibility. Instead of addressing these more complicated issues, businesses have been focusing on more accessible and approachable numbers. From conversational metrics such as sentiment to share of voice to customer-centric marks such as Net Promoter Score to Net Reputation Score; from Trust to Influence; and from engagement to advocacy and everything in between; businesses are keen to quantify relevance in new social channels even at the sacrifice of visceral outcomes.

New metrics systems and conversation tracking tools are showing increasing signs of promise every day. But once collected, what do these numbers actually mean and how do they translate into true business value or insights?

Again, there is measuring what is and also capturing what is…truly happening.

Jeff Bezos once famously said that your brand is what people say about you when you’re not in the room. We can now thank social networks, blogs and democratized content platforms such as YouTube for amplifying what people say when you’re not around. Why should you be thankful for these platforms?

The answer is, because you’re given the gift of access to the honest accounts of your customers’ experiences. And it is those experiences that are feeding interests, answering questions, and guiding and validating decisions.

This isn’t news; it also isn’t fully appreciated yet. What people say contributes to a collective consciousness that informs and influences customers who enter the awareness and consideration phases of the customer decision journey. As customers move through their journey it is their experiences that feed back into an ever-shifting influence loop.

Creating a comprehensive journey map would reveal nothing less than what the customer experience (CX) of your business actually is and where it’s happening.

Journey mapping reveals many things including:

- Are customer expectations met or unsatisfied?

- Are your customers asking questions that go unanswered?

- Are there influencers who are pushing customers toward or away from you?

- Are there ideas or reactions that could improve what it is you do and how you do it today?

- Where are the networks, what are the apps, and which sites are impacting what my customers see, learn, and do?

- What do people really think about you and how do those reactions touch and inspire you to improve?

That’s the power of shared experiences. And this is why becoming a digital ethnographer will shape your ability to create and steer future experiences in every moment of truth to your benefit.

Would you recommend us to a friend?

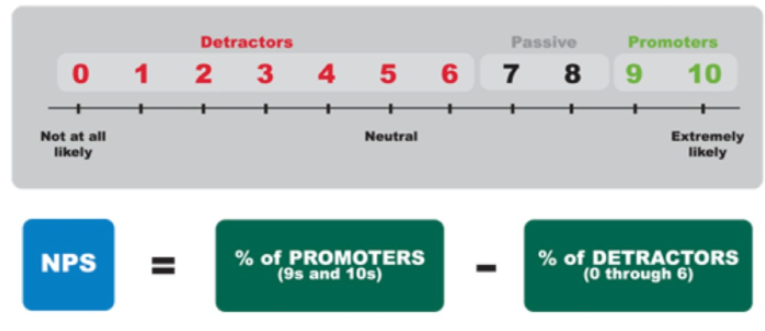

Dubbed “the ultimate question,” the idea of whether or not people would refer your products to friends and family has given rise to a wildly popular benchmark for measuring customer satisfaction used by many business strategists today

Developed by Satmetrix2 , The Net Promoter Score3 (NPS) helps businesses assess customer satisfaction by asking one simple question. Typically presented through a survey or customer satisfaction form, the question of, “How likely is it that you would recommend [company] to

a friend or colleague?” assigns businesses an overall score. This score serves as a symbol of customer satisfaction and also an industry benchmark when compared to others in your sector.

The answer allows businesses to see the world through the eyes of their customer to measure performance and hopefully opportunities to explore ways to improve experiences. To do so, NPS categorizes customers into three categories: Promoters, Passives, and Detractors.

They are described as follows:

Promoter: A promoter is someone who is likely to recommend a product or service. They’re loyal enthusiasts who will keep buying and also refer others to do so, thus fueling overall business growth. In the realm of word of mouth, they are most likely talking positively about the product experience or would if prompted. They are, of course, among the most influential in the measurement of overall customer lifetime value.

Passives: Passives are customers who are indifferent. They are satisfied but fall into complacency lacking enthusiasm and open to competitive offerings. These customers do not necessarily add to or take away from decision-making.

Detractors: Detractors however, well, they’re the customers who would not recommend your product. Detractors are unhappy customers who can and will damage your brand every chance they get causing brand harm and risk through negative word-of-mouth.

Customers respond on a 0-to-10 point rating scale. Customers who “take away” from shared positive sentiment are considered Detractors and they’re measured between 0-to-6 on the NPS scale. Customers who rate the likelihood of recommending your business at 7 or 8 are considered Passive. Those customers who say that they are “extremely likely” rate a 9 or a 10.

To calculate the NPS for your organization, simply subtract the percentage of Detractors from the Percentage of Promoters.

According to Satmetrix, leading businesses with the most efficient growth engines, those actively seeking to improve customer experiences, operate with an NPS of 50 to 80. Average companies tend to mosey along at an NPS of only 5 to 10, which translates into a reality where Promoters barely outnumber Detractors. As Satmetrix noted, Promoters barely outnumber their Detractors. And, companies with a better ratio of Promoters to Detractors exhibit tendencies to grow more rapidly than their competitors4.

In March 2012, Satmetrix released the results of its annual Net Promoter® Benchmark Study5. USAA, Amazon.com, Costco, Virgin America, Apple, Trader Joe’s, and Wegmans were among the highest in customer loyalty.

Equally, Satmetrix also found that a significant number of companies suffered from blasé or negative customer sentiment with companies spanning a range of industries including financial services, health insurance, telecommunications, Internet service providers, and cable and satellite TV. What are some of those companies who fell in at below the middle of the road? You might recognize a few…Wachovia, American Airlines, Sears, Mediacom and T-Mobile.

Whether real or perceived, these scores, which represent how customers rate experiences, are a measure of what’s deserved. Either way, perception is reality. And these scores say everything if someone is willing or unwilling to recommend your product or service.

But how does a score help plan for growth or improve performance, capabilities and ultimately experiences? And, in a real time social web, how do expressed sentiments and shared experiences contribute to the real world influence of customer decision making?

What are customers actually saying in between surveys?

As you may or may not have heard me say before, I truly believe that context is king.

Perhaps NPS is showing its age, but if an experience economy is the successor to the social economy, expressions form impressions and impressions influence decisions. Therefore, something more substantial and directive is required.

What someone would say in a review of your product or service is dependent largely on the state or context of the experience and the relationship.

Here’s an example. Do you see a glass with water at the halfway mark as half full or half empty?

One way to look at the scenario is through a lens of context. Is someone pouring or drinking from it at the time.

The glass is half full until it’s half empty.

Or…

The glass is half empty until it’s half full.

In the real world, your product, service, or staff affect experiences before, during, and post transactions. Something could come along and change your perspective at any moment.

Let’s say you’re driving a new car. It drives well. Everything works as promised. You feel

amazing driving it. If you took the NPS survey at this point, you’d most likely give high marks. But then you take the car in for service and everything changes. The service manager is uncommunicative and dismissive. The repair is done haphazardly. The car is at the moment, not a pleasure to drive. Take the survey now, even if it’s something easily fixable through repair and/ or an apology, and you’re likely to not recommend this product.

It’s constantly a game of the state of the state.

With shared experiences in social media filling in the gaps between formal surveys, businesses must consider real-time sentiment in addition to other traditional customer satisfaction scores. What people feel or experience is shared in social networks. This isn’t new. But what we’re not considering is how these shared expressions impact NPS and ultimately the true state of customer satisfaction.

To help companies get a better view of social customer sentiment, Satmetrix introduced a more modern metric. Unlike NPS, SparkScore6 factors in social media’s role in the NPS ecosystem. “Ecosystem,” or, perhaps more accurately, “egosystem,” is where customers share experiences within their social networks. People are after all at the center of their own digital universe. As a result, the SparkScore is a collection of Total SparksTM representing conversations and activities across platforms including Twitter, Facebook, Google+, LinkedIn, blogs, Pinterest, and others.

The SparkScore Sentiment Engine, powered by Metavana, combines the methodology of Net Promoter with expressed customer sentiments in the social graph and assigns businesses another performance score. As Satmetrix explains, “With SparkScore, brands are able to recover detractors and mobilize promoters at the speed of the social web, delivering customer love.”

Said another way, engaging unhappy customers can turn them into happy or tranquil customers. If you can identify your happy customers, you can engage them in advocacy programs. But again, this is more about managing “what is” instead of moving toward “what could be” by engaging customers to improve experiences.

If people express satisfaction, don’t you want to know why?

If people express discontent, wouldn’t you want to know the experiences behind this sentiment so you could fix it?

Now’s the time to explore the root causes of experiences to change them for the better or to encourage those that are already positive. Otherwise, we build a support and reward infrastructure that manages symptoms and not the problem.

This is why measuring NPS or SparkScore only tells part of the story. If you’re measuring the success of your business based on scores that are more immediate than they are telling, then you limit your efforts to changing only what is immediately relevant. If you only look for the “what” and not the “why,” your customers and your future bottom line will not be optimized.

See, customer experiences are incredibly emotional and people go out of their way to share those experiences when they really love or hate something. If you think about online ratings for a moment, there are really only two scores that count—5 stars and 1 star. So, in the social web, people are doing just that, adding color around the 5’s and 1’s and influencing people along the way. But why? Why are they sharing these experiences and how are they impacting those around them?

Remember, context is king.

Never mind the question, would you recommend it…did you actually recommend it?

Within social media, brands are presented with both risks and opportunities. All of the shared experiences that take place there become part of a collective index that influences customer decisions and impressions throughout the dynamic customer journey7. If you think back to the anecdote of most reviews reflecting sentiment of either 1’s or 5’s, it’s clear that people are either referring customers to your company or they’re convincing them to look elsewhere.

Suddenly the question of “would you” refer our business seems insignificant when a connected customer relies on the words and experiences of friends or like-minded individuals as they actively seek to make decisions in real-time. This new reality should motivate businesses to think beyond the number and look at what experiences are shared, surface patterns, and seek opportunities to exceed expectations.

It is this premise that inspired me to consider new metrics to justify experimentation, demonstrate performance and progress, and surface instances for innovation or co-creation.

I didn’t have to look very far to find the answers.

Several years ago, I studied real-time conversations and attempted to map expressions to the NPS framework. The work focused on manually scouring blogs, Twitter, YouTube, Facebook and other relevant social networks based on the market for each business. The key difference here is that I was capturing more than stated intent; I was analyzing honest sentiment shared in the moment, whether good, bad or indifferent.

If you’ve ever tried to measure sentiment, you know that its accuracy is questionable at

best. Yet businesses track customer sentiment in social media to assess promoters, passives and detractors as one big faceless group. Combined with NPS, sentiment simply provides a generalized state of emotion. As such, strategists are often left without any insight toward assessing experiences or feeling the empathy necessary to design and inspire more desirable experiences in the future.

Something more was needed.

I then looked at extracting shared expressions over the course of fixed periods of time, in most cases monthly or quarterly. I would then organize the conversations using Amazon Turks to manually assess positive, neutral, and negative conversations. This delivered a far more accurate depiction of customer sentiment, but it was only the beginning of what’s actually possible.

NPS and the measurement of intention or general sentiment are simply not good enough.

You’re either ready to do this work because you want to better understand customer experiences in order to improve them or you’re convinced that your organization can benefit from enhanced customer experiences and you need tangible evidence to create a sense of urgency. In each case, metrics such as NPS serve merely as a standing or rank. If you earn a high score, your strategies and approach are validated. If your score is low, your intentions, master plan, and supporting processes, people, and technology should come under review.

There’s more work to do.

To effectively create desired experiences takes understanding what customers actually experience and share with others. That feedback should inspire refinements or directional changes in any and all areas affected by research and analysis.

Introduced to me by my good friend Paul Greenberg, I was inspired by the work of Dr. V. Kumar. VK as he is more popularly known is one of the world’s foremost experts in customer and marketing strategies that improve experiences and profitability. He is the Richard and Susan Lenny Distinguished Chair Professor of Marketing, and Executive Director, Center for Excellence in Brand and Customer Management, Robinson College of Business at Georgia State University.

VK contributed an essay in the Harvard Business Review8 that discussed the value of word of mouth and how to measure customer lifetime value (CLV). While much of the article examines statistical models on how to measure CLV and also customer referral value (CRV), shared experiences aka referrals are pegged as instrumental in the ability to influence decisions for or against you.

In these interconnected days, how your customers feel about you and what they are prepared to tell others about you can influence your revenues and profits just as much.

Looking back to the question that drives NPS, “Would you refer us?” pales in importance to something far more substantial and tangible.

In an interview with CRMSearch9, Paul Greenberg explained how VK reframed the question and expanded the survey to four queries. The goal was to better assess a more tangible form of customer referral value.

- Would you recommend the company to someone you know?

- Did you recommend this company to someone you know?

- Did they become a customer?

- Are they a profitable customer?

These questions shifted the study of intention to that of action and value.

To be fair, Satmetrix agrees that NPS is not enough. As they share on the site for NPS, it’s more than a numbers game…

Net Promoter programs are not traditional customer satisfaction programs, and simply measuring your NPS does not lead to success. Companies must follow an associated discipline to actually drive improvements in customer loyalty and enable profitable growth. They must have leadership commitment, and the right software and business processes in place to deliver real-time information to employees, so they can act on customer feedback and achieve results.

Indeed.

Social Referral Value (SRV)

The work presented by Dr. V. Kumar and also examined by Paul Greenberg introduced a more meaningful process to measure the state of customer intentions, experiences and customer value. It challenged me to take my experiments one step further.

Following the classification of manually assembled customer sentiment into three groups, positive, neutral, and negative, I then attempted to organize them by themes. This was done with the help of software of course, but it allowed me to see experiences that people loved, those they disliked, and where they were confused or challenged. I uncovered patterns in experiences that substantiated strategies, product designs, and business processes/resources and I also found series of opportunities to learn from or address these experiences.

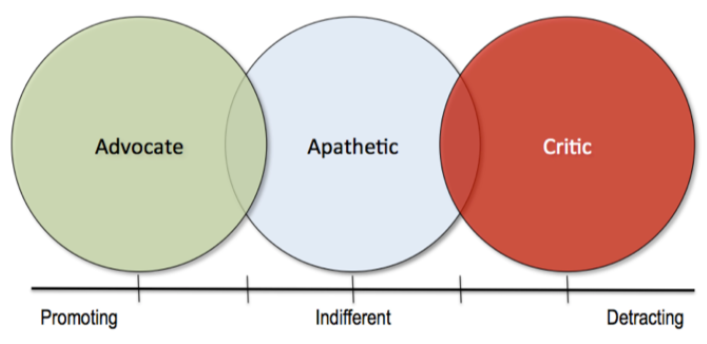

A simple way of looking at real-time promoters and detractors as highlighted by NPS is to look at conversations through the lens of social referral value (SRV). Now, I realize of course that the word “social,” at least in the echo chamber of which many of us live, is becoming the expressional equivalent of a persona non grata among experts. However, in this case, I don’t mean social as in social media. I am referring to social referral value in a literal context.

As such, the concept of SRV is proposed as a framework for consideration, not as the basis for yet another new trendy metric. Allow me to explain.

Up to this point, we’ve established that there are different types of customers doing things differently based on how and where they connect. We have metrics and ROI methodologies for traditional customers. It is the connected customer, who is arguably representative of the future, where new metrics and methodologies are required. Hence this SRV considers shared experiences in new networks that live online and influence actions and reactions in every moment of truth.

This isn’t based on theory; this is based on experience.

The SRV I experimented with (and still continue to) looked at all digital (social, mobile, community) conversations around a particular company over a fixed span of time. This netted out an entirely new world of experiences than were tracked by NPS or any other traditional process. And, that’s why this model is important for further study and expansion. You’re invited to join the effort.

To effectively score sentiment and shared experiences requires human analysis. For our experiments, we hired a team to review large sample sizes of dialogue. We then sorted conversations into three buckets. No score was necessary for each because it’s not a hypothetical measure. Either they did or did not endorse a brand.

First, those who expressed praise, support or an official recommendation for a product were considered Advocates. The second groups were those conversations that were Apathetic, those conversations that were neutral, indifferent or inconclusive. Most conversations fell in this category, which may or may not be a surprise. The last category of course are the Critics, those individuals who like NPS, are the Detractors of your market driven by the negative experiences they encountered.

With NPS, the Net Promoter Score = % of Promoters minus the % of Detractors.

With a simplified SRV metric, your score = the % of advocates minus the sum of Critics. Like Advocates and Critics, the Apathetic are also valuable. Studying themes within each group provides insights in how to move those in the middle and the right over to the left.

The Power of Shared Experiences

As Dr. V. Kumar shared in his Harvard Business Review article, “How your customers feel about you and what they are prepared to tell others about you can influence your revenues and profits…”

Shared experiences are in fact powerful and we are just now starting to better understand the extent of the social effect. It is perhaps more important and convincing than many businesses realize. To appreciate the impact of shared experiences starts with stepping outside of traditional NPS or sentiment metrics. To improve experiences and more positively influence what people say and share requires the study of shared experiences today. This will help you optimize the influence loop in the dynamic customer journey to contribute positively to each moment of truth.

Each moment of truth contributes to social touch points that test brand awareness and strength and also the strength of common customer experiences. What’s asked or shared and what surfaces at each step of the customer journey defines the next steps of your would-be customer.

Remember, at the center of the digital journey is the Influence Loop. Shared experiences are fed into the loop, forever indexed, and extracted during each moment of truth along the journey. Whether through traditional or social search, asking questions within one’s social graph, or simply reading reviews, shared experiences, whether good or bad, affect impressions and actions. The importance of the influence loop cannot be understated. What NPS, the SparkScore and SRV represent are both a state of customer sentiment and also a window to customer experiences. Doing so not only increases the score, it improves the quality and nature of customer relationships. It also sets the stage for bona fide advocacy to feed positive experiences back into the influence loop.

Benchmark Against Best in Class, not Just the Competition

We are meandering through a market in transition with as much direction as one applies to an unfamiliar maze. To lead others through the maze you have to find a path of course. But naturally you will make mistakes. It’s time to put NPS, SparkScore or a general social score as proposed here to the test.

After conducting several studies on social scores and the dynamic customer journey, I can say with the utmost certainty that the results will be enlightening. The challenge of course remains, what to do with the insights?

After all, the scores will provide a benchmark and offer clarity as to where you are and where you can go. Additionally, by running comparative studies on competition and also companies deemed to be best in class in other industries will provide context on performance and also highlight what’s possible.

In the end, these scores and the accompanying insights will provide businesses the opportunity to inform and influence marketing, sales, service, and loyalty strategies that improve experiences. But it won’t stop there. The role social and mobile media plays in the dynamic customer journey is nothing short of transformative. Designing and re-aligning experiences is critical as it is those shared experiences that reverberate across the touch points in the influence loop. It is how other customers discover those experiences that defines outcomes. Through access to this research and social scoring, you’ve been given the gift of discovering the keys to relevance. You’ve also been given an invitation to help shape the new customer journey.

Yes, the amount of work was at the very least onerous. Part technology and part human, the process of gathering thousands of mentions, assembling a team to parse their feelings, and then harnessing the results was time-consuming. You have to actually care about customer experiences to perform this research. And, to do so means that your organization already possesses or is at the cusp of possessing a culture of customer-centricity.

Shared experiences are everything after all. Therefore put the time and passion in to study what “is” to define and reinforce what “should” be. This is why transformation must be less about technology and more about social science.

What’s the Future of Business Bonus Chapter by Brian Solis from Brian Solis

Footnotes

1 http://www.terry.uga.edu/~rgrover/chapter_29.pdf

2 http://www.netpromoter.com/about-satmetrix/

3 http://www.netpromoter.com/why-net-promoter/know/

4 http://www.netpromoter.com/why-net-promoter/compare/

5 http://www.satmetrix.com/company/press-and-news/pr-archive/pr20120314/

6 http://www.spark-score.com/

7 http://www.briansolis.com/2012/04/the-rise-of-generation-c-and-what-to-do-about-it/

8 http://hbr.org/2007/10/how-valuable-is-word-of-mouth/ar/1

9 http://www.crmsearch.com/paulgreenberg.php